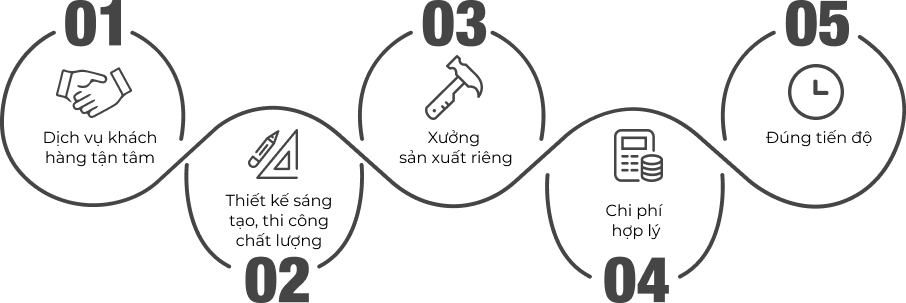

Lý do lựa chọn T&T Design

Chúng tôi đã có

2465

Khách hàng

368

dự án thi công

568

dự án thiết kế

Quy trình thiết kế thi công

Blogs

Bí kíp thiết kế shop thời trang nữ thu hút khách

Có thể nói cách trang trí và bài trí cửa hàng đóng vai trò vô cùng quan trọng trong việc thu hút khách hàng tiềm...

Tư vấn thiết kế nội thất chung cư hợp phong thủy đón tài lộc

Phong thủy là yếu tố tâm linh và nó là yếu tố quan trọng khi thiết kế nội thất chung cư. Thiết kế nội thất...

Cách trang trí trưng bày nội thất siêu thị mini hiệu quả

Bạn có biết rằng cách sắp xếp kệ trưng bày siêu thị tác động rất lớn đến việc tăng doanh thu cho doanh nghiệp?...

.png)

.jpg)